Capital Structure: 7 Forms That Will Kill Your Business

Every company, from a Silicon Valley startup to a 100-year-old manufacturing company, needs money to operate and grow. How a company gets that money—the mix of debt and equity it uses—is its capital structure. It’s the foundation of your business, and getting it wrong is one of the most common, yet least talked about, reasons a successful company can suddenly fail.

Many entrepreneurs focus on product and sales and ignore the capital structure of their company. This decision determines not only your profitability but also your ability to withstand market downturns. Bad financing decisions can turn short-term success into long-term distress.

This guide will show you what capital structure is, why the simple debt vs equity decision is a minefield and most importantly, the 7 toxic forms of capital structure that will kill your company.

What is Capital Structure

In simple terms, capital structure is the mix of a company’s long-term funding sources. It’s the combination of funds raised from owners (equity) and funds borrowed from external parties (debt).

The key components that make up the capital structure of a company are:

-

Debt: Long-term loans, bonds, debentures, mortgages.

-

Equity: Common stock (ordinary shares), preferred stock, retained earnings.

The goal is to find the optimal capital structure—the combination of debt and equity that minimises the company’s weighted average cost of capital (WACC) and maximises the overall value of the firm. That’s where the financial risks lie.

The 7 Toxic Forms of Capital Structure (And How to Avoid Them)

While theory offers many variations, these 7 imbalanced and non-optimal capital structure forms are the most likely to lead to financial distress or bankruptcy.

1. The Ultra-Aggressive Debt-Heavy Structure

This one is all debt, all the time. Too much borrowed money, often with a debt-to-equity (D/E) ratio way above the industry average.

-

The Big Risk: When EBIT fluctuates, interest payments are fixed. This is massive financial leverage. In a downturn, even a small drop in revenue and the company can’t pay its interest and will default and potentially go bankrupt.

-

Why it Kills: It takes away financial flexibility. High debt means the company can’t take on new profitable projects or withstand economic shocks, effectively boxing the firm into a bad financial position. This is the fastest path to bankruptcy.

2. The Pure Equity Structure (The Growth Killer)

A company that uses no debt is often considered low-risk. But this safety comes at a huge cost: missed opportunities and a higher cost of capital.

-

The Shocking Risk: Debt is often cheaper than equity because interest payments are tax-deductible (a tax shield) and creditors demand a lower rate of return than equity investors. A pure equity-funded capital structure gives up this tax advantage and forces the company to use more expensive capital.

-

Why it Kills: It dilutes ownership unnecessarily. By only issuing equity to raise growth capital, existing owners’ stakes are diluted again and again, and the return on equity (ROE) is lower than it could be with strategic leverage. It’s a slow self-inflicted wound to shareholder value.

3. The Short-Term Debt Trap

This is when a company uses short-term debt (like commercial paper, bank overdrafts or short-term loans) to finance long-term assets (like machinery, real estate or R&D).

-

The Scary Bit: It creates a mismatch between asset life and liability maturity. When the short-term debt comes due, the firm hasn’t generated enough cash from the long-term assets to pay it off, and the company has to constantly roll over the debt.

-

Why it Kills: It exposes the firm to interest rate risk and rollover risk. If interest rates suddenly rise or creditors get nervous and won’t refinance the debt, the capital structure is instantly unsustainable, and the firm is in a liquidity crisis.

4. The Complex Hybrid Overload (Diluting Clarity)

This involves a bunch of complex financial instruments like convertible preference shares, detachable warrants and exotic debt instruments.

-

The Horror: The capital structure becomes a black box, making it impossible for management, creditors or investors to know the true financial risk and leverage ratios. The conversion options in these instruments can create hidden debt or imminent equity dilution.

-

Why it kills: It introduces too much uncertainty into the capital structure of the company. When these hybrid instruments convert or mature, they can trigger a sudden, unplanned change in the debt-to-equity ratio or earnings per share (EPS) and cause investor panic and stock price volatility.

5. The Low-Earning Retained Earnings Trap

Retained earnings are profits a company keeps to reinvest in the business, a great source of internal equity capital. But relying too much on retained earnings when the business isn’t highly profitable is a major capital structure flaw.

-

The Big Risk: If a low-profit business avoids external financing and only uses its small retained earnings, it starves itself of the scale and pace it needs to grow. The opportunity cost is huge.

-

Why it kills: It stops the business from leveraging cheap debt (if available) or growth-boosting external equity. The business grows too slowly to compete, falls behind competitors who used an optimal capital structure to gain scale.

6. The Preference Share Heavy Structure (Hidden Cost)

Preference shares (or preferred stock) are a hybrid instrument that offers a fixed dividend rate, paid before common shareholders. A capital structure heavily weighted toward preference shares has a unique risk.

-

The Shocking Risk: Unlike debt interest, preference dividends are not tax-deductible. The effective cost of preference share capital is therefore much higher than debt, as the company must pay the dividends out of post-tax profits.

-

Why it Kills: While preference shares don't carry the bankruptcy risk of debt (failure to pay a dividend is not a default), they create an unnecessarily high overall cost of capital. The firm is paying a premium for a hybrid that offers less tax benefit than debt and less growth potential than common equity.

7. Unsecured Debt Dominance

A capital structure with a big chunk of unsecured debt (no collateral, like property or equipment) is a high risk for smaller businesses.

-

The Horror: Unsecured debt has a much higher interest rate because the risk to the lender is higher. This increases the company’s cost of capital and fixed payments.

-

Why it Kills: In a bankruptcy, unsecured creditors are last in line to get paid, so they are super nervous in tough times. A firm with this structure has no bargaining power with its lenders in distress, as the lenders have nothing to lose by forcing immediate liquidation, effectively killing the company.

Conclusion: The Balancing Act

Choosing the capital structure of your business is a balancing act between risk and return. Debt can amplify returns (financial leverage), but too much debt amplifies the risk of bankruptcy. Equity offers stability and flexibility but dilutes ownership and often costs more due to the lack of a tax shield.

The truth is, even a successful business can be brought down by one of these seven bad capital structure choices. Regular, expert analysis is essential to make sure your funding mix is aligned to your current earnings stability, growth phase, asset base and industry norms. A dynamic and optimal capital structure is the unsung hero of long-term business resilience and value creation.

How Can Flyingcolour Tax and Consultant Help You?

At Flyingcolour Tax and Consultant, we know that a good capital structure is the foundation of business valuation and stability. Our financial experts provide targeted, jurisdiction-specific advice to ensure your capital structure is built for growth, not risk.

-

Capital Structure Audits: We review your current debt-to-equity ratios against industry benchmarks and identify which of the 7 toxic forms (if any) are currently threatening your business.

-

Optimal Financing Strategy: We model different financing scenarios to find the right mix of debt, equity and internal capital that minimises your WACC and maximises shareholder value.

-

Tax Shield Maximisation: We advise on structuring debt to maximise the tax benefits available under the current rules, legally reducing your cost of capital.

-

Financial Flexibility Planning: We help you structure your financing so you have enough borrowing capacity and liquidity to take advantage of unexpected market opportunities without incurring huge risk.

Work with Flyingcolour to turn your capital structure from a source of hidden risk into your greatest competitive advantage.

FAQ

1. What is the optimal capital structure, and why is it important for a company?

The optimal capital structure of a company is the combination of debt and equity that gives the lowest Weighted Average Cost of Capital (WACC) and thus the highest market value of the company’s stock. It’s important because it directly impacts profitability, financial risk and ability to get funding at good rates in the future.

2. Is debt or equity better for a startup?

For most early-stage startups, equity is the better option. Debt introduces fixed interest payments, which can be crushing when revenue is uncertain. Equity (from founders, angel investors or VCs) provides patient capital that aligns with the high-risk, high-growth nature of the venture. Debt is introduced once the company has stable cash flows.

3. How does the current interest rate environment affect a company’s capital structure decision?

When interest rates are low, debt becomes cheaper, and a more leveraged capital structure looks attractive due to the tax shield and lower cost of capital. When interest rates are high, the cost of debt goes up sharply, and equity is relatively more attractive, and companies with high debt face refinancing risk.

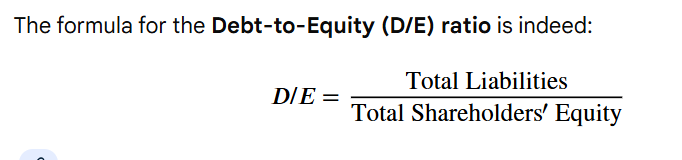

4. What is the Debt-to-Equity (D/E) ratio, and what is considered healthy?

There is no universal healthy figure; it varies by industry. But a D/E ratio of 1.0 to 1.5 is often considered standard. A ratio above 2.0 is generally considered aggressive; the company relies heavily on debt to finance its assets.

5. What are the main theories that explain how firms choose their capital structure?

The two main opposing theories are:

-

Trade-Off Theory: Suggests companies seek an optimal D/E ratio by balancing the benefits of debt tax shield against the costs of financial distress (bankruptcy risk).

-

Pecking Order Theory: Companies prefer to fund investments using internal funds first (retained earnings), then debt and finally external equity (new stock issues). External equity is the most expensive and sends a bad signal to the market.

To learn more about The Hidden Truth About Capital Structure: 7 Forms That Will Kill Your Business, book a free consultation with one of the Flyingcolour team advisors.

Disclaimer: The information provided in this blog is based on our understanding of current tax laws and regulations. It is intended for general informational purposes only and does not constitute professional tax advice, consultation, or representation. The author and publisher are not responsible for any errors or omissions, or for any actions taken based on the information contained in this blog.