Dubai Import Duty A Complete Guide for Businesses

Dubai has become one of the most important global trade hubs, and many Indian businesses look at Dubai as a gateway to the Middle East, Africa, Europe, and Asia. As more Indian companies explore import and export opportunities in the United Arab Emirates, understanding dubai import duty becomes essential. This topic affects product pricing, supply chain decisions, profit margins, and compliance requirements for every importer dealing with the Dubai market. The rules are clear and the system is designed to support international trade, but business owners still need a simple and easy explanation of how Dubai import duty works, what the slabs are, how much tax applies on different products, and what Indian importers must understand before shipping goods to Dubai.

This complete guide explains everything in simple language. It covers how much import duty is in Dubai, how Dubai calculates charges on different products, what taxes Indian companies should expect, how to save costs legally, and how to manage compliance smoothly. The goal is to help Indian importers understand the Dubai trade system without confusion and make well informed decisions with confidence.

What is Dubai Import Duty

Dubai import duty is the tax charged on goods when they are brought into the United Arab Emirates. Every country applies some form of tax on imported goods, and Dubai has its own structured system that follows the UAE customs regulations. The duty is usually calculated as a percentage of the cost of the goods, including insurance and freight. The system is simple, transparent, and predictable, which makes Dubai one of the easiest places for Indian companies to import goods.

For most goods, the standard import duty in Dubai is five percent. However, some products have different rates depending on their category. A few items have higher duty because they fall under restricted or controlled items, while others are fully exempt because they are essential goods or government protected categories. Understanding these categories helps Indian businesses estimate costs and plan their supply chain effectively.

Why Indian Businesses Should Understand Dubai Import Duty

India and Dubai share a strong trade relationship. Many Indian traders use Dubai as a base to distribute products to multiple international markets. Whether you are importing raw materials, finished products, machinery, electronics, textiles, or food items, knowing the exact duty and tax rules will help you save money and avoid penalties. Indian businesses that deal with Dubai often ask questions like how much is tax in Dubai, what the tax slab in Dubai looks like for imports, and whether Dubai has GST. These questions matter because taxes directly impact total landed cost and profit.

Understanding Dubai import duty brings several major benefits for Indian businesses including better financial planning, more accurate pricing, improved compliance, fewer delays at customs, and smoother trade operations. With accurate knowledge, businesses can negotiate better with suppliers and logistics providers and avoid hidden costs that commonly affect new importers.

How Much is Dubai Import Duty for Indian Businesses

The common question Indian importers ask is how much is tax in Dubai for imported products. The standard import tax for the majority of goods is five percent. This applies to most categories including clothes, furniture, electronics, household items, machines, and general consumer products. This five percent duty is one of the lowest in the world, which makes the UAE a very attractive destination for global trade.

But Indian businesses must understand that some products have different duty rates. For example, tobacco products have significantly higher duty because they fall under a special category. Alcohol also has a higher duty and excise tax. Luxury goods may also carry different duty depending on classification. On the other hand, some goods are completely exempt from import duty, especially essential food products, medical equipment, pharmaceuticals, newspapers, books, and educational materials.

Tax Slabs in Dubai for Importers

Many Indian business owners think Dubai has GST or a complicated tax slab system similar to India. In reality, Dubai does not follow a traditional gst in dubai structure. Instead, Dubai uses a simple customs duty structure with clear categories.

Below are the standard slabs for Dubai imports described in easy language.

- Zero percent duty applies to essential goods, educational material, medicines, fresh food, meat, fish, raw materials, gold, and many industrial inputs.

- Five percent duty applies to most general goods imported by Indian businesses. This is the most common slab and covers the majority of products.

- Higher percentage duty applies only to a small list of controlled items such as tobacco, carbonated drinks, and energy drinks. Alcoholic beverages also have high duty and an additional excise tax.

- This structure helps businesses plan their costs more accurately compared to countries where tax slabs are complex and constantly changing.

Understanding Dubai GST Rate

Many people search for dubai gst rate or gst in dubai. It is important to clarify that Dubai does not have GST in the same format as India. Dubai has a Value Added Tax system, which is a flat rate of five percent on goods and services. This VAT applies after import duty is calculated. So Indian importers must understand the difference between import duty and VAT.

Import duty is charged by customs. VAT is charged by the tax authority. VAT is applied on the total value of the goods including import duty. This is why calculating the total landed cost of a shipment requires accurate understanding of both charges.

Dubai also has excise tax on specific harmful products like tobacco, energy drinks, and carbonated beverages. Indian companies dealing in these categories must include excise tax while calculating final pricing.

Key Products Imported into Dubai

Indian businesses often request a list of items commonly imported into Dubai to understand where opportunities lie. Dubai imports a large variety of goods from India because of the strong trade partnership and low import duty structure. The most popular categories in the dubai import products list include electronics, mobile accessories, garments, spices, food products, machinery, automobile spare parts, personal care items, jewellery, steel and building materials, and home décor items.

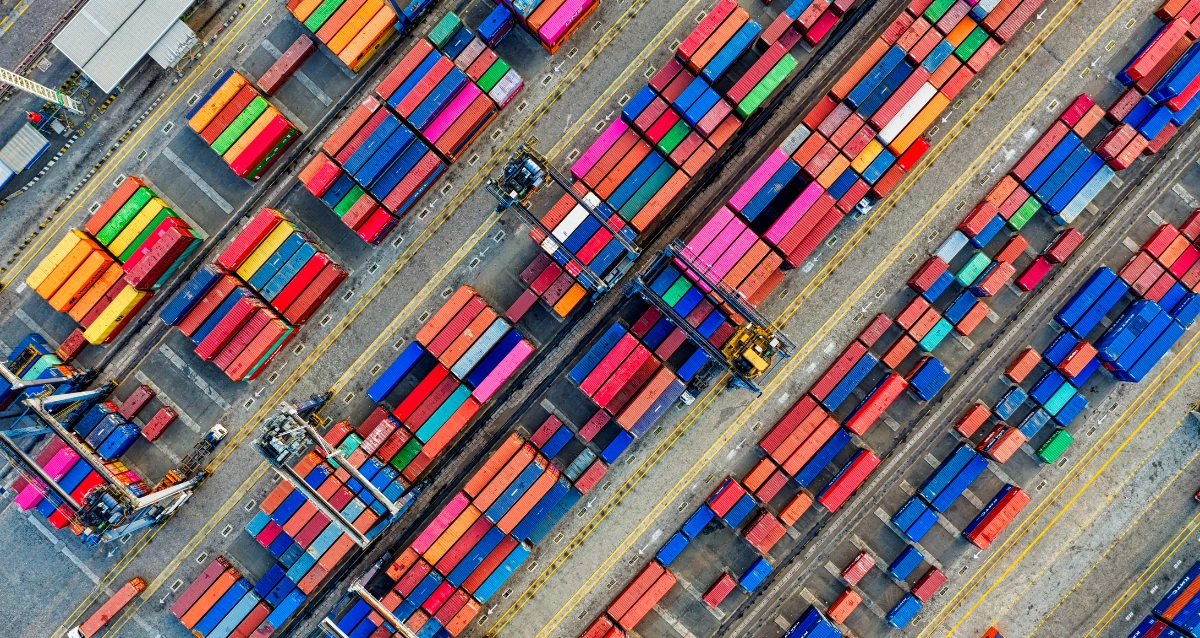

Dubai acts as a major re export hub. Many Indian companies import goods into Dubai and then ship them further to Africa, Europe, the Middle East, and Central Asia. This makes Dubai a profitable distribution center for Indian manufacturers and traders.

How Dubai Import Duty is Calculated

Indian businesses must understand the calculation process to avoid mistakes. Dubai customs uses a method called cost insurance freight value. This means the duty is calculated on the total value of the goods including the product cost, insurance, and freight charges. After calculating the duty, Dubai applies VAT on the final value.

Understanding this formula helps in planning profit margins and negotiating better with suppliers and freight forwarders. It ensures the importer knows exactly how much will be paid at customs and prevents any surprise charges.

Common Mistakes Indian Importers Make

Many Indian businesses new to the Dubai market make simple errors that can be avoided with proper guidance. These include choosing the wrong product category, under declaring value, failing to maintain correct documentation, misunderstanding VAT rules, not checking restricted items, and relying on verbal information instead of official customs guidelines. These mistakes lead to delays, fines, or additional inspections. By understanding dubai import duty clearly, businesses can avoid these issues and operate smoothly.

Dubai Free Zones and Import Duty

Indian businesses must know that goods imported into Dubai Free Zones do not attract customs duty as long as the goods remain inside the free zone. This is why many Indian companies use free zones as warehousing hubs. If goods are moved into the mainland, import duty becomes applicable. Free zones provide many benefits including 100 percent foreign ownership, simple licensing, fast setup, and tax advantages. Many Indian importers choose to operate through free zones to reduce costs and expand distribution to international markets.

Products Exempt from Dubai Import Duty

There are many categories where no duty is charged. Medicines, medical equipment, books, newspapers, educational tools, fresh vegetables, fruits, fish, raw materials for manufacturing, military equipment for official use, and certain humanitarian goods are fully exempt. Indian companies dealing in these categories can benefit greatly because Dubai customs encourages essential and developmental trade.

Is Dubai Import Duty Low Compared to Other Countries

Yes, Dubai import duty is significantly lower compared to many countries. Many nations charge a combination of import duty, GST, cess, surcharge, safeguard duty, and anti dumping duty, which increases the cost of goods. Dubai keeps the system simple and low, which helps businesses grow. This is one of the main reasons why Indian companies find Dubai an attractive market for trade.

How Much Tax in Dubai for Imports

To give a simple answer for Indian importers, the common tax flow is duty at five percent for most goods, VAT at five percent on top of cost plus duty, and excise tax only for specific categories like tobacco or energy drinks. For general goods, Indian companies can expect a total cost of around ten percent tax burden after combining all charges. This is still lower compared to many countries, which is why Dubai remains a powerful trade gateway.

What Indian Importers Should Keep Ready for Customs

Indian businesses must ensure clean documentation. Dubai customs is strict but very professional, and they clear shipments fast if documents are correct. Importers must prepare a commercial invoice, packing list, bill of lading or airway bill, certificate of origin, import code, and any special certificate depending on the product. Proper documentation prevents delays and ensures the shipment moves smoothly.

Why Dubai is a Top Market for Indian Importers

Dubai offers benefits that other markets do not. The location is strategic and connects multiple continents. The tax system is simple and low cost. Logistics are fast and world class. The market size is large and diverse. Indian products have strong demand among residents, tourists, and regional markets. Dubai also provides opportunities for re export, which increases business potential. Many Indian companies use Dubai as their second home for international expansion.

Practical Tips for Indian Importers to Save Costs

Indian businesses can save money by selecting competitive shipping routes, choosing the right free zone, negotiating with logistics companies, understanding correct product classification, using proper documentation, taking advantage of zero duty items, planning shipments to reduce storage charges, and working with experienced tax consultants like Flyingcolour Tax India. These strategies help Indian importers operate with higher profit margins.

How Flyingcolour® Tax India Can Help

Flyingcolour® Tax India supports Indian businesses by simplifying the entire process of importing goods into Dubai. The team helps you understand Dubai import duty, VAT rules, documentation requirements, customs clearance procedures, and compliant tax planning. With professional guidance, Indian companies avoid mistakes, save money, and speed up operations. Flyingcolour Tax India provides advisory support, compliance services, cost calculation assistance, product classification guidance, and end to end custom documentation support. With years of experience, the team ensures Indian businesses enter the Dubai market confidently and operate smoothly without facing unexpected challenges.

Conclusion

Dubai import duty is simple, predictable, and business friendly. The low import duty system, clear tax slabs, and structured customs rules make Dubai a powerful trading destination for Indian businesses. Whether you are an established importer or a new entrepreneur planning to begin trading with Dubai, understanding how much tax applies on different products, how the system works, and what documents are needed will help you make better business decisions. Dubai continues to attract Indian traders because it is easy to do business, cost effective, and offers strong global opportunities. With the right guidance from Flyingcolour Tax India, businesses can import into Dubai confidently, stay compliant, and achieve long term success.

To learn more about Dubai Import Tax A Complete Guide for Businesses, book a free consultation with one of the Flyingcolour team advisors.

Disclaimer: The information provided in this blog is based on our understanding of current tax laws and regulations. It is intended for general informational purposes only and does not constitute professional tax advice, consultation, or representation. The author and publisher are not responsible for any errors or omissions, or for any actions taken based on the information contained in this blog.