Why UAE Business Owners Choose Tax Agents Over Tax Consultants for Their Tax Matters

The requirements to comply with tax compliance in the UAE have become more complex than compared to what it were earlier. The recent requirements emphasise Corporate Tax, VAT, Excise Tax, transfer pricing, tax audits, e-invoicing, penalty reconsiderations, and constant regulatory updates.

Now the question of every business owner is “Should we hire a Tax Agent or just a Tax Consultant?”

However, both offer tax-related services; they are not the same. In recent times, we observe that the UAE business owners are choosing the FTA-approved Tax Agents due to the fact that they are more regulated and reliable.

Let’s dive into the detailed explanation of why Tax Agents are the first choice for UAE companies today!

1. Only Tax Agents Are Licensed & Approved by the Federal Tax Authority (FTA)

As per the Federal Law No. 7 of 2017 of the Tax Procedures, a Tax Agent is a person who is officially approved to handle the tax matters on behalf of the client. This means:

- They must pass the FTA Tax Agent exam

- They must undergo a strict background & qualification check

- Approved Tax Agents are listed on the official FTA register

- Approved Tax Agents can legally represent companies before the FTA

Whereas a regular Tax Consultant has NO legal authority to represent/deal with the FTA on behalf of your entity.

This is the primary reason why Tax Agents are the preferred choice.

2. Tax Agents Can Represent You in FTA Audits — Consultants Cannot

This is not a MYTH!!! Yes, in case of any FTA audits, assessments or penalty disputes:

- Only a licensed Tax Agent can represent you to inspectors on your behalf you

- FTA provides access to confidential information only to the Tax Agent

- Apart from the authorised signatory/shareholders of the entity, only a Tax Agent can respond on behalf of the taxable person

- Tax Consultants cannot represent an entity in front of the FTA for clarification or documentation.

We can see that every smart UAE business owner wants someone legally allowed to represent them in the FTA.

3. Tax Agents Submit Reconsideration Requests and Handle Penalty Cases

Listed below are the common penalties business entities may encounter in the UAE:

- Corporate Tax penalties

- VAT late payment penalties

- Reverse-charge errors

- Wrong tax treatment

- Deregistration penalties

- E-invoicing violations

Considering that your entity has encountered penalties for any of the above violations, only a Tax Agent can file a reconsideration or objection on your behalf and legally communicate with the FTA until the case is resolved. Whereas a Tax Consultant can only “advise” and cannot act on your behalf. This will hamper your business and tax credibility.

4. Tax Agents Understand UAE Tax Law in Depth — Not Just Theory

The primary responsibility of an FTA-approved Tax Agent is to demonstrate expertise in:

- Corporate Tax

- VAT

- Tax Procedures

- Free Zone rules (QFZP, Excluded Activities, PE risks)

- Transfer Pricing

- DMTT (Domestic Minimum Top-up Tax)

- E-Invoicing compliance

Also, becoming a Tax Agent is not just a one-time activity; the Tax Agent must ensure that they are updating their knowledge on all the recent updates of the UAE Tax Law to keep their license active and they will have to submit proof of their Continuing Professional Development.

This ensures the business receives compliant, updated, and practical tax advice, and not something a tax consultant can guarantee.

5. Tax Agents Reduce Risk of Penalties & Disputes

Every business owner looks forward to avoiding penalties and to keep their books clean and compliant as per the tax requirements, hence they choose Tax Agents to ensure that they do not fall into the fate of:

- Late return penalties

- Incorrect filing penalties

- Record-keeping violations

- Misinterpretation of exemptions

- Incorrect VAT rate application

- Corporate Tax calculation errors

- E-invoicing implementation penalties

Appointing a knowledgeable Tax Agent strengthens compliance and protects the business even before an FTA audit happens.

6. Priority Support in Corporate Tax & VAT Registration / Deregistration

Tax Agents are well aware of the requirements and trained to handle:

- Corporate Tax registration

- VAT registration

- Tax deregistration

- Tax group formation

- Corporate Tax clarifications

- VAT clarifications

Getting the services done through a Tax Agent ensures applications are accepted quickly without delays or rejections by the FTA.

7. Tax Agents Follow a Regulated Code of Conduct

Yes! Being a Tax Agent is just not a name; the Tax Agent must comply with the following requirements:

- FTA professional ethics

- Confidentiality standards

- Anti-money laundering (AML) rules

- Due diligence obligations

Knowing that a Tax Agent is following these requirements builds trust on the business owners, and they are at ease knowing that the entity’s tax requirements are handled well by a knowledgeable person.

On the other hand, the Tax Consultants do not have mandatory FTA-governed ethical oversight, and this is an alarm that most of them had ignored.

8. Business Owners Prefer One-Stop Tax Support

Every business owner wants their requirements to be dealt with by a single person, rather than running from person to person on various things, this will not only reduce the hassle but also gives them the opportunity to work on their business requirements.

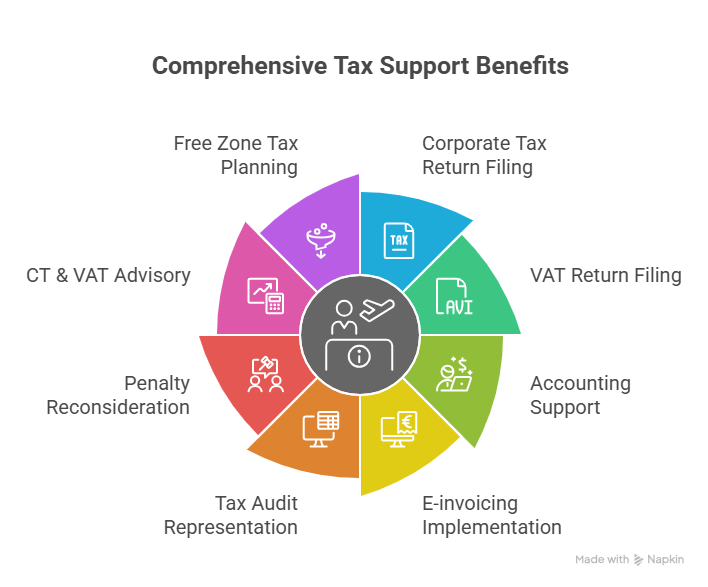

Opting for a Tax Agent will be an ideal option as they will handle everything end-to-end, which includes:

- Corporate Tax return filing

- VAT return filing

- Accounting support

- E-invoicing implementation

- Tax audit representation

- Penalty reconsideration

- CT & VAT advisory

- Free Zone tax planning

Considering that the business owner engaging with a Tax Agent ensures consistency and eliminates fragmented advice.

9. Tax Agents Understand UAE Free Zone Rules Better Than Anyone

A Tax Agent will be the person who will not just read the law requirements to you, but rather advise you based on whether you are:

- Free Zone "Qualifying Free Zone Person"

- Mainland entity

- Branch

- Holding structure

- SPV

- Family office

A Tax Agent provides specialised tax interpretation aligned with:

- MD 229 of 2025 & MD 230 of 2025

- Cabinet Decision No.100 of 2023

- Article 18 (QFZP)

- Excluded activities

- De minimis test

- PE rules

- Qualifying income test

Whereas Tax Consultants often lack in-depth advisory and would just line up with the normal conditions, resulting to losing your eligible tax benefits.

10. Cost-Effective in the Long Run

Many business owners think, appointing a Tax Agent is expensive, but in reality:

One mistake made by a consultant can cost you more than hiring a Tax Agent for the whole year.

- Tax Agents prevent:

- · Incorrect corporate tax treatment

- · VAT misclassification

- · Failure to register

- · Failure to retain documents

- · E-invoicing non-compliance

- · Avoidable penalties

These may sound simple, but they save thousands in fines and protect reputation.

Why Flying Colour Tax Consultant — Your Trusted FTA-Approved Tax Agent in Dubai

Flyingcolour Tax Consultant is known for:

✔ FTA-approved Tax Agents (Corporate Tax + VAT)

✔ 21+ years of UAE tax & compliance experience

✔ 15,000+ companies assisted across sectors

✔ Zero-penalty track record for correctly filed returns

✔ Experts in free zone corporate tax planning

✔ Experts in structuring International Business models in a tax-effective and compliant way.

✔ Specialised support in tax audits & disputes

✔ Complete accounting + tax + compliance under one roof

Whether you need Corporate Tax, VAT, E-Invoicing, Transfer Pricing, or tax audits, our licensed Tax Agents ensure your business remains fully compliant.

Final Word: UAE Business Owners Prefer Tax Agents for a Reason

- They are legally authorised

- They offer better protection

- They understand the UAE law deeply

- They minimise risk

- They communicate directly with the FTA

- They deliver peace of mind

A Tax Consultant can advise, A Tax Agent can protect.

To learn more about Why UAE Business Owners Choose Tax Agents Over Tax Consultants for Their Tax Matters, book a free consultation with one of the Flyingcolour team advisors.

Disclaimer: The information provided in this blog is based on our understanding of current tax laws and regulations. It is intended for general informational purposes only and does not constitute professional tax advice, consultation, or representation. The author and publisher are not responsible for any errors or omissions, or for any actions taken based on the information contained in this blog.