UAE Free Zone Holding Company Tax: Achieve 0% Corporate Tax

Disclaimer: This article is for informational purposes only and is based on Flying Colour Tax Consultant LLC’s understanding of UAE Corporate Tax regulations as of the date of publication. It should not be considered formal tax or legal advice.

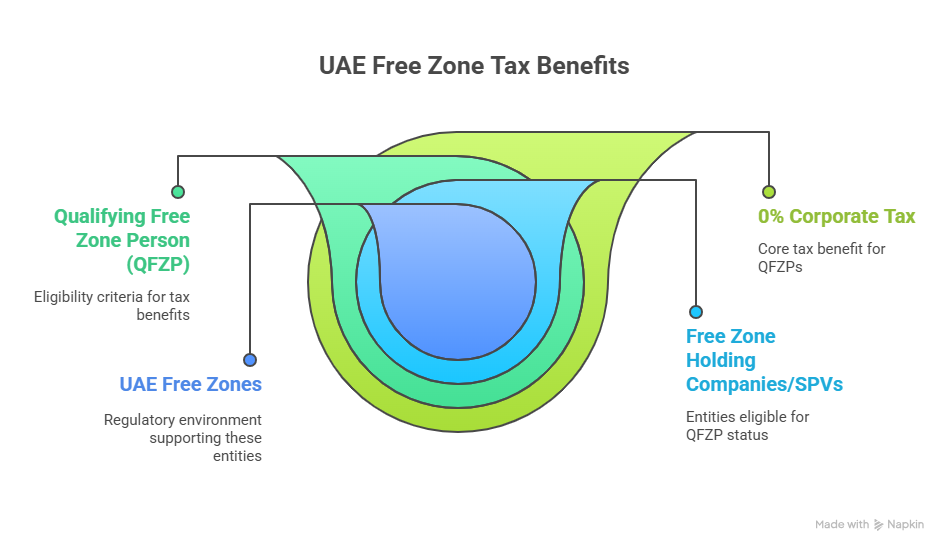

The UAE has become a prominent jurisdiction for setting up holding companies and Special Purpose Vehicles (SPVs), especially within the Free Zones. With the introduction of Corporate Tax under Federal Decree-Law No. 47 of 2022, following up with Ministerial Decisions, the Holding, SPV structures can benefit from 0% Corporate tax regime, provided they should satisfy the conditions for a Qualifying Free Zone Person (QFZP).

This blog explains how Free Zone holding companies and SPVs can benefit from 0% Corporate Tax, the eligibility criteria, restrictions, compliance requirements and real-world examples.

What Is a Free Zone Holding Company or SPV?

A holding company is setting up primarily to invest in:

- Shares of the subsidiaries

- The Securities and other assets

- Intellectual property

- Long-term strategic investments

On the other hand, an SPV is aiming to hold a specific asset or particular financial and legal risk, which is commonly used for real estate investments, Joint Venture structures, fund setups or corporate reorganisations.

These structures often have:

- · No employees

- · Very minimal operating expenses

- · Only passive investment income

UAE Free Zones provide a cost-efficient and flexible regulatory environment for these legal structures.

What Is a Qualifying Free Zone Person (QFZP)?

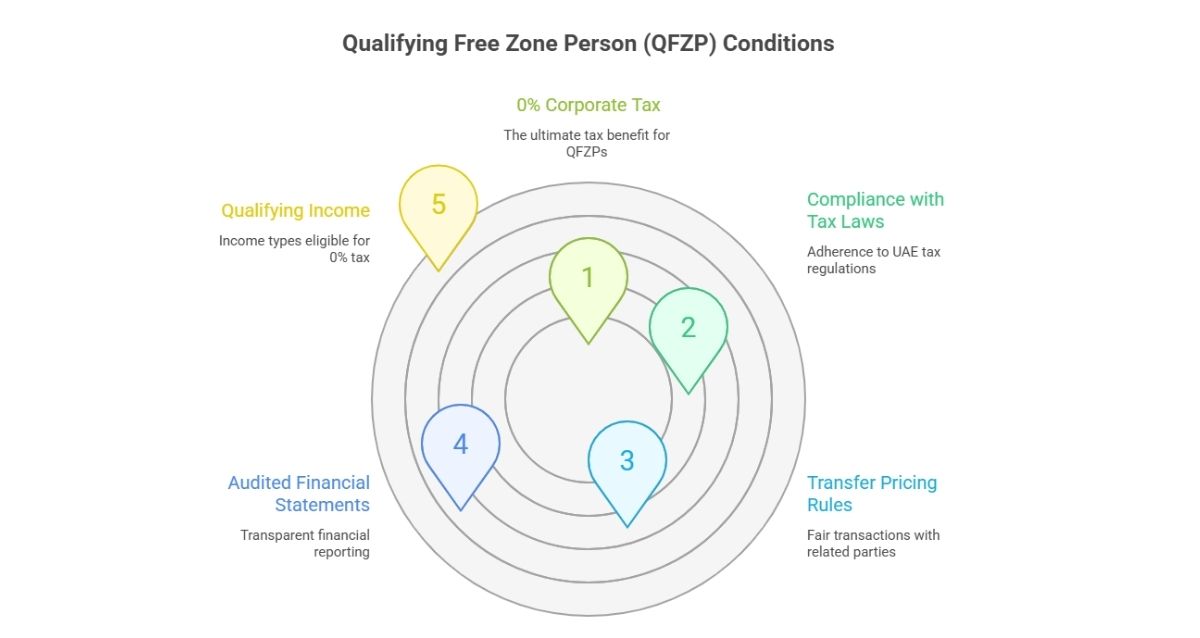

To get 0% Corporate Tax on Qualifying Income, a Freezone entity must meet all of the following conditions:

1️. Maintenance of adequate substance in a Free Zone

2️. Should earn Qualifying Income as defined under Ministerial Decisions

3️. Should prepare and maintain audited financial statements

4️. Related party transactions must follow Transfer Pricing rules

5️. Has not voluntarily elected for a standard of 9% corporate tax

6️. Complies with UAE tax laws and reporting requirements

Failure to meet any of the above conditions will result in losing the privilege of QFZP for the current tax year and the subsequent four tax years. In short, they will fall under 9% corporate tax regime.

Why Free Zones Benefit Holding Companies and SPVs

Under the provisions of the latest Ministerial Decisions, the Corporate Tax law recognises:

Holding of shares and securities as a Qualifying Activity

This means holding companies and SPVs earning income such as:

- Dividends

- Capital gains

- Proceeds from the disposal of assets

- Fair value gains

May qualify for a 0% corporate tax rate, subject to the conditions.

Additionally, the UAE CT law already exempts many passive investment returns under various criteria:

- Participation exemption

- Dividend exemption

- Capital gain exemption

This results in a highly tax-efficient framework for regional and global asset holding structures.

What Income Is Eligible for 0% Corporate Tax?

For holding companies and SPV structures, the following income may fall under the definition of Qualifying Income:

- Dividends from its subsidiaries, either UAE or from Foreign

- Capital gains resulting from the disposal of shares

- Proceeds from liquidation

- Income from ownership and sale of securities

- Income from ancillary activities supporting a qualifying activity

If structured promptly, the above income will be taxed at 0%, which will make the UAE a highly competitive nation.

What Income May Be Taxed at 9%?

A holding company or SPV may lose the 0% Corporate tax benefit if it earns the below:

❌ Income from excluded activities

(examples: financing to unrelated parties, managing real estate)

❌ Income attributable to a domestic permanent establishment

❌ Non-qualifying revenue earned from the Mainland

If non-qualifying income is earned, only that portion of total income may be subject to 9% corporate tax, unless the entity fails all the conditions for a QFZP.

Real Example

Scenario:

A DIFC-based SPV owns 100% shares of three functional companies. One in the UAE mainland and two overseas.

Income earned in the year:

- AED 3.2M dividends from subsidiaries

- AED 800K capital gain from disposal of shares

✅ Holding of shares is a Qualifying activity

✅ Income derived from the investment is a Qualifying income

✅ Proper Audited Financial statements and adequate substance maintained

Result → 0% Corporate Tax benefit

However, if the same SPV, along with the holding, started providing consultancy services to mainland companies, that consulting revenue will be taxed at 9% corporate tax.

Key Compliance Requirements

In order to get the benefit of QFZP, the SPV or Holding company must:

✅ Maintain board resolutions and decision-making in the respective Free Zone

✅ Maintain adequate substance to prove before the authority, like office space, governance, operating expenditure, etc

✅ Maintain proper audited financial statements

✅ File annual corporate tax returns without failure

✅ Maintain transfer pricing documentation for related party transactions

✅ Issue e-invoices when required under upcoming regulations

Compliance is not optional; it is mandatory. FTA will ask for and review all supporting documents we are maintaining.

Why the UAE Is Attractive for Holding Structures

- 0% Corporate tax on qualifying income

- No withholding tax on dividends, interest or royalties as of now

- No tax will be charged on capital gains

- 100% foreign ownership is permitted

- A wide range of double tax treaty agreements with different nations

- Strong corporate governance frameworks (ADGM, DIFC, DMCC)

For global investors, family offices, private equity firms and multinational groups, UAE Free Zones provide a stable, legally recognised holding jurisdiction.

Common Mistakes Leading to Disqualification

- Absence of properly audited financial statements

- Conducting excluded or operational activities

- Failure to maintain adequate substance

- Providing services to non-free zone clients without proper tax structuring

- Electing for 9% Corporate tax by mistake

- Inadequate or non-maintenance of required transfer pricing documentation

Proper planning on time prevents unnecessary tax exposure.

How Flyingcolour Tax and Consultant Can Help?

Our tax experts assist with:

- Efficient structuring for holding companies & SPVs in free zones

- Assessment of QFZP eligibility

- Expert advisory on Corporate tax and return filing

- Guide you on the Economic substance and accounting setup

- Preparation of Transfer Pricing Documentation

- Restructuring and tax-efficient group planning

Final Thoughts

Free Zone holding companies and SPVs will continue to enjoy significant corporate tax benefits UAE. Especially the 0% Corporate tax on qualifying income. However, the compliance, documentation, and structuring matter more than ever.

Before setting up a holding entity, businesses should conduct a professional corporate tax assessment to avoid unintended 9% corporate tax exposure.

Frequently Asked Questions (FAQs)

1️. Can a holding company in a Free zone earn mainland income and still get 0% tax?

Yes, but 0% tax will be applicable only on qualifying passive income, such as exempt dividends or capital gains. Income from an Active business may be taxed at 9%.

2️. Do SPVs require employees to meet substance requirements?

Not required always. Depending on the activities they are conducting, board resolutions and outsourced employee functions may be sufficient.

3️. Are audited financial statements mandatory for QFZP status?

Yes, without properly audited accounts, the entity will lose 0% tax benefit automatically.

4️. Do all Free Zones offer the same tax benefits?

Yes, corporate tax rules apply federally, but licensing requirements differ across Free Zones.

5️. Can a mainland company be owned by a Qualifying Free Zone holding company?

Yes. The ownership structure does not affect the eligibility for getting dividend and capital gain exemptions.

To learn more about Qualifying Free Zone Benefits for Holding Companies and SPVs in the UAE, book a free consultation with one of the Flyingcolour team advisors.

Disclaimer: The information provided in this blog is based on our understanding of current tax laws and regulations. It is intended for general informational purposes only and does not constitute professional tax advice, consultation, or representation. The author and publisher are not responsible for any errors or omissions, or for any actions taken based on the information contained in this blog.