Updated FTA Service Fees in the UAE: What Businesses Need to Know About Cabinet Decision No. 65 of 2020 and Its Amendments?

UAE Federal Tax Authority has updated Cabinet Decision No.65 of 2020 by reflecting the revised service fee, compliance requirements and administrative processes. The revised fee structure is implemented with effect from 01.01.2026

The new updates are important for most people dealing with the Federal Tax Authority, including businesses, tax agents, software vendors, free zone entities, and individuals seeking a tax residency certificate or clarification on VAT, Corporate Tax, and Excise Tax. It is imperative to understand the fee to ensure smooth compliance, planning of the budget.

Below is a clear, simplified breakdown of what this Decision covers and the key fee changes that are now in effect.

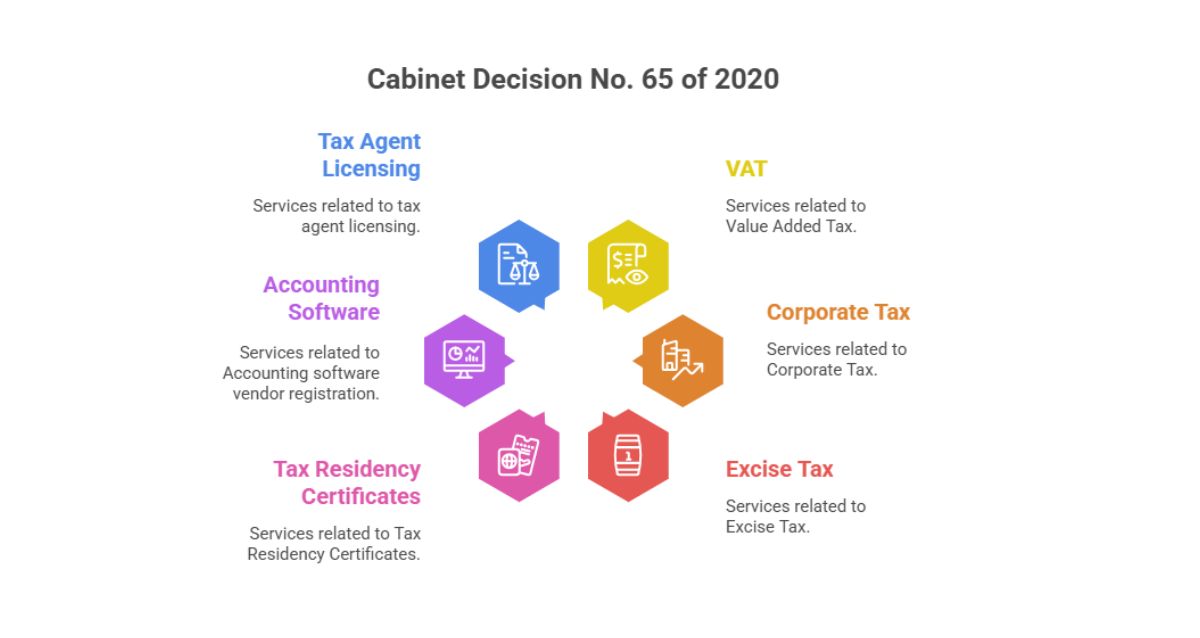

What Does Cabinet Decision No. 65 of 2020 Cover?

Cabinet Decision No. 65 of 2020 enacts the official fees payable for the services provided by the Federal Tax Authority, which includes services related to VAT, Corporate Tax, Excise Tax, Tax Residency Certificates, Accounting software vendor registration, and tax agent licensing. It consolidated and replaced the previous fee structures related to the listed services.

The Decision has undergone three amendments:

- Cabinet Decision No. 7 of 2023 – effective 1 June 2023

- Cabinet Decision No. 111 of 2023 – effective 1 December 2023

- Cabinet Decision No. 174 of 2025 – effective 1 January 2026

The above three key amendments revised the fee amounts and introduce new services, such as the fees related to Advance pricing Agreements (APAs) for Transfer Pricing.

Key FTA Service Fees (Updated in 2023 & 2025)

Below are the most important fees any business must be aware of:

1. Tax Agent Registration

The Registration fee for:

- Natural Person Tax Agent: AED 3,000 - valid for 3 years

- Juridical Person Tax Agent: AED 10,000 - valid for one year

This fee is the same for both new registrations and renewals.

2. Accounting Software Vendor Registration

- Accounting software vendor registration and renewal is AED 10,000 per year

This is applicable to software companies that require FTA approval for VAT and e-invoicing compatibility.

3. Tax Residency Certificate (TRC)

- Application Fee: AED 50

- TRC for FTA registrants: AED 500

- TRC for Legal Persons (non-registrants): AED 1,750

- TRC for Natural Persons: AED 1,000

- Paper Copy: AED 250

4. Certificate of Commercial Activities

- Application Fee: AED 50

- Issuance Fee: AED 500

- Paper Copy: AED 250

5. Private Clarifications Fee (VAT, CT, Excise)

- One tax: AED 1,500

- Multiple taxes: AED 2,250

This applies to official written clarifications signed by the FTA’s Director General or delegate.

6. Advance Pricing Agreements (APAs) – New in 2026

- New APA Request: AED 30,000

- APA Renewal or Amendment: AED 15,000

This applies for multinational groups involved in Transfer pricing

7. Designated Zone Registration (Excise Tax)

- AED 2,000 per year

Why These Fees Matter for Businesses

For Businesses, it is key to understand the FTA’S fee structure as it helps them:

- To meet the compliance requirements without any delays. As TRN applications, Tax Residency Certificates, clarifications, and software registrations require the payment of the applicable fees.

- Effective Budgeting of Annual renewals especially for tax agents, software vendors, and excise designated zones.

- Get ready for the e-invoicing transition with the introduction of phased e-invoicing from 2026 to 2027. Many business would engage Accredited Service Providers (ASP) and may rely on FTA-approved vendors.

- Manage International Tax Obligations. The introduction of APA fess marks a major development especially for multinationals preparing for Pillar Two rules and stronger TP documentation

Impact of 2025 Amendments: What’s New?

Amendment under Cabinet Decision No. 174 of 2025 (effective 1 Jan 2026) introduced:

- APA-related fees

- Updates aligned with expansion of tax systems including Corporate Tax

- Revised fee structures to reflect increasing workload in tax matters

This reflects the UAE’s alignment with global tax standards and the progressive development of its corporate tax framework.

Conclusion

Cabinet Decision No. 65 of 2020 and its amendments acts as the backbone of the UAE’s official FTA service fee structure. For many including businesses, tax agents, free zone entities and even individuals remaining updated of these fees is critical for avoiding delays with compliance matters, efficient tax planning and eliminating any penalties.

These fees reflects how the country’s tax system is getting more advanced as the UAE continues to enforce corporate tax, e-invoicing, transfer pricing, and international tax standards.

Our team at Flying Colour Tax Consultant LLC is here to help you, if your business requires help understanding these fees, applying for certificates, or managing FTA registrations.

FAQs

1. Are the FTA service fees the same for all businesses?

The fees are not the same for all businesses. Fees differ based on whether the applicant is a natural person, legal entity, tax registrant, or non-registrant. Some fees such as APA’s apply only to large multinational groups.

2. Does the FTA refund fees if an application is rejected?

Yes, but only in few situations like private clarifications. The fees may be refunded if the FTA does not issue the clarification.

3. Are these fees applicable for both VAT and Corporate Tax services?

Yes, the fee structure is applicable across tax administration services under VAT, Excise Tax, Corporate Tax, and Tax Procedures Law.

4. Do these fees apply to e-invoicing accreditation?

Yes, it is very relevant for E-invoicing ASP’s. They must pay AED 10,000 annually to remain as FTA registered ASP’S.

5. How can I pay FTA service fees?

Through the EmaraTax Portal, all payments are processed using the available online payment methods.

To learn more about Updated FTA Service Fees in the UAE: Key Changes Under Cabinet Decision No. 65 of 2020, book a free consultation with one of the Flyingcolour team advisors.

Disclaimer: The information provided in this blog is based on our understanding of current tax laws and regulations. It is intended for general informational purposes only and does not constitute professional tax advice, consultation, or representation. The author and publisher are not responsible for any errors or omissions, or for any actions taken based on the information contained in this blog.