Registration Requirement Under UAE Corporate Tax

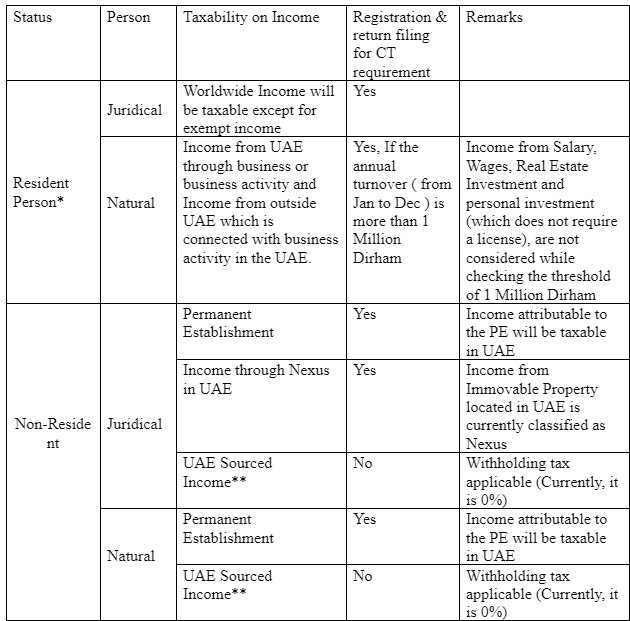

It is important to understand for each person the requirements of registration and filing tax returns under Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses. The below table will give a summarized view on the registration requirements for

*Below are considered as Resident Person for Corporate Tax purpose

-All companies incorporated/established/recognized as per UAE applicable legislation.

- A company which is incorporated/established/recognized as per the foreign legislation, but effectively managed and controlled in the UAE.

- A Natural person who conducts business or business activity in UAE.

** UAE Sourced income – Some examples

- Income from the sale of goods in the state

- Income from services rendered or utilized or benefitted from the UAE ( Example:- Game

- Income from movable or Immovable property in the UAE.

- Income from sale of shares of a resident person.

- Income from contract performed in the UAE.

- Income from use or right to use of intellectual or intangible property in the UAE.

- Interest earned from UAE subject to conditions

- Insurance or reinsurance premium earned from UAE subject to condition.

Read More Latest Blogs.

To learn more about Registration Requirement Under UAE Corporate Tax, book a free consultation with one of the Flyingcolour team advisors.

Disclaimer: The information provided in this blog is based on our understanding of current tax laws and regulations. It is intended for general informational purposes only and does not constitute professional tax advice, consultation, or representation. The author and publisher are not responsible for any errors or omissions, or for any actions taken based on the information contained in this blog.