The Economic Substance Regulations require every company (called a licensee) to file an ESR notification annually to the Federal Tax Authority (FTA) if they carry out ‘Relevant Activities’ as provided in the regulation. Failure to do so attracts penalties, and the licensee will be given a time limit during which he can file an appeal against the penalties imposed.

This blog aims to explain ESR penalties, the timeframe was given to submit an appeal, and how to file an ESR appeal.

What is an Appeal, and who can file an Appeal?

When a licensee receives a notice from the authority notifying him of any offense or violation made against the ESR regulations, the licensee gets a chance to defend his action of a breach or crime by submitting a request in the form of appeal.

Article (17) of the resolution provides the right to appeal to the licensee or exempted licensee if he receives notification from the authority of the violation and meets one of the following grounds -

- He did not violate the regulation; or

- The authority did not impose the penalty proportionately to the violation;

- The amount of imposed administrative penalty is more than the limit prescribed.

ESR Penalties and Timeframe to Apply the Penalties

Article (13), (14), and (15) of the Cabinet Resolution No 57 of 2020 provides the following penalties for the offenses mentioned below:

Failure to Provide Notification (Article 13)

The National Assessing Authority will notify the licensee or the exempted licensee if the licensee fails to submit the notification and other relevant information within six months from the end of the financial year.

The authority will impose an administrative penalty of AED 20,000 for failure to notify the authority as provided in the regulation.

Failure to Submit ESR and Meet Economic Substance Test (Article 14)

The authority will impose a penalty if -

- The licensee fails to submit the Economic Substance Report (ESR) within 12 months after the financial year ends.

- The licensee fails to meet the requirements of the Economic Substance Test as provided in the regulation.

The imposition of the administrative penalty will be AED 50,000 for the first-time commitment of the offense, whereas; the penalty amount will be AED 400,000 for the subsequent offenses.

Submission of Inaccurate Information (Article 15)

When the licensee knowingly submits inaccurate information to the authority, he will be imposed an administrative penalty of AED 50,000.

Timeframe to Apply the ESR Penalties

ESR penalties under articles (13) and (14) cannot be imposed after the lapse of six years from the date of committing violations.

Whereas the ESR penalty under article (15) should be imposed before the expiry of 12 months from the date, the authority came to know about the violation.

5 Steps to File an ESR Appeal

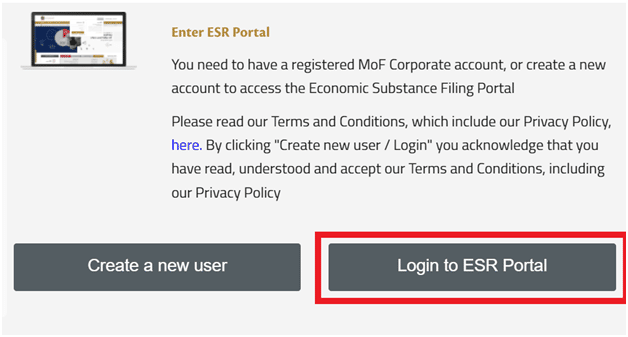

Step 1

The licensee must log in to the ESR portal to submit the request for an ESR appeal, after which you will be taken to the dashboard called ‘Homepage.’

Step 2

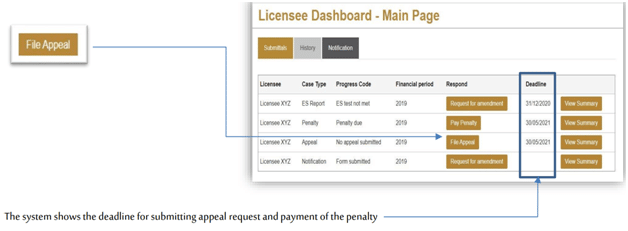

You will see various columns under the ‘Submittal’ tab on the dashboard. It has columns such as Licensee, Case Type, Progress Code, Financial Period, Respond, and Deadline.

You can click on the ‘File Appeal’ button located in the ‘Respond’ column to proceed to file an appeal.

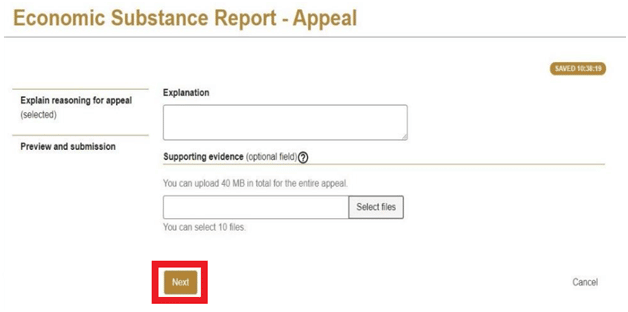

Step 3

After clicking the ‘File Appeal’ button, you will be taken to the appeal request page, where you will have to provide a simplified reason that justifies why you were not able to meet the requirements of the regulation and attach supporting documents up to a maximum of 10 documents of not more than 40 MB.

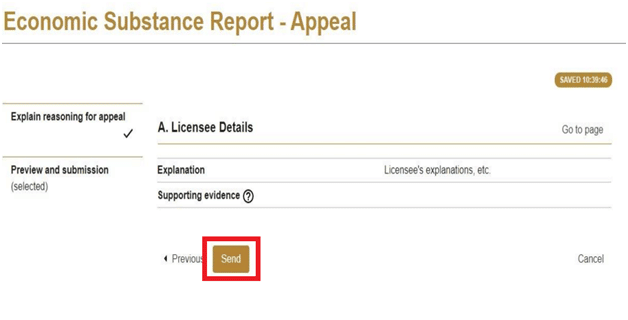

Step 4

After you click on the ‘Next’ button on the appeal page, you will be asked to review the application. Once you check the explanation and have attached the requisite documents, you can click on the ‘Send’ button to apply.

Step 5

Upon successful submission of the request, you will receive a message stating that ‘Your submission has been received.’ The status of your appeal will change to ‘Appeal Submitted’ from ‘No Appeal Submitted.’

Conclusion

Licensees may panic when they receive a penalty notification from the authority because you have been provided the right to appeal against the penalties. It is advisable to seek professional help before proceeding with an appeal to better understand the regulations and eligibility requirements.

How Can We Help?

Our expert professionals can help you comply with the ESR reporting requirements and appeals against the penalty imposition. Contact us if you have any queries; we are happy to serve you earliest.

To learn more about How to File an Appeal for ESR Penalty, book a free consultation with one of the Flyingcolour team advisors.

Disclaimer: The information provided in this blog is based on our understanding of current tax laws and regulations. It is intended for general informational purposes only and does not constitute professional tax advice, consultation, or representation. The author and publisher are not responsible for any errors or omissions, or for any actions taken based on the information contained in this blog.