As a general procedure, VAT (Value Added Tax) in the UAE applies to the supply of all goods and services that take place within the territorial area which includes both mainland and free-zones. However, certain free-zones listed under a cabinet decision qualifies for special VAT treatment with some limitations. These nominated zones are known as Designated Zones and are treated as being outside the territory of the UAE for VAT purposes for specifies goods and supplies.

Therefore, designated zones are:

· subjected to a strict control.

· required to have security procedures in place to control the movement of goods and people to and from the Designated Zone;

· required to have Customs procedures to control the movement of goods into and out of the Designated Zone

· treated as being outside the territory of the UAE for VAT purposes for certain supplies of goods.

VAT registration for designated zones can be done through the FTA website after creating an e-services account with the FTA.

However, for a designated Zone to be treated as outside the UAE for VAT purposes, they should fulfill the following criteria:

1. The Designated Zone must be a specific fenced geographic area.

2. The Designated Zone must have security measures and Customs controls in place to monitor the entry and exit of individuals and movement of goods to and from the Designated Zone.

3. The Designated Zone must have internal procedures regarding the method of keeping, storing and processing of goods within the Designated Zone.

4. The operator of the Designated Zone must comply with the procedures set out by the FTA.

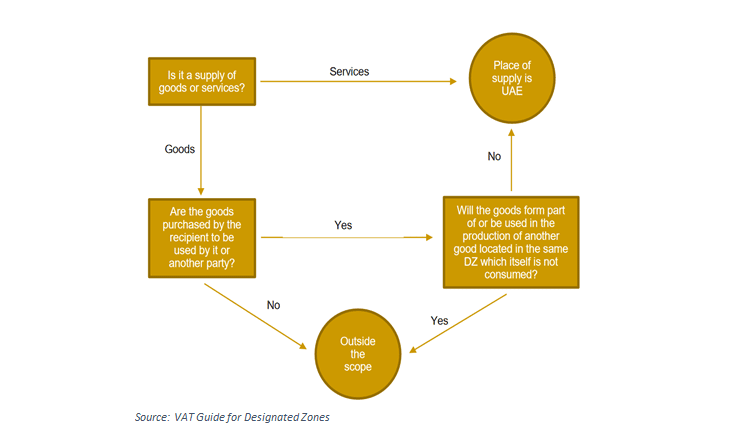

However, the supply of services is usually considered as within the UAE and comes under the normal procedures of VAT in the UAE.

In case of goods,

- Supply of goods into a Designated Zone from outside of the UAE- No VAT charges.

- Supply of goods from mainland UAE to a Designated Zone- Normal VAT charges.

- Transfer of goods within Designated Zones- Out of Scope given that the goods are not altered and are in accordance with the VAT procedures.

List of current Designated Zones in the UAE:

Abu Dhabi

- Free Trade Zone of Khalifa Port

- Abu Dhabi Airport Free Zone

- Khalifa Industrial Zone

- Al Ain International Airport Free Zone

- Al Butain International Airport Free Zone

Dubai

- Jebel Ali Free Zone (North-South)

- Dubai Cars and Automotive Zone (DUCAMZ)

- Dubai Textile City

- Free Zone Area in Al Quoz

- Free Zone Area in Al Qusais

- Dubai Aviation City

- Dubai Airport Free Zone

- International Humanitarian City – Jebel Ali

Sharjah

- Hamriyah Free Zone

- Sharjah Airport International Free Zone

Ajman

- Ajman Free Zone

Umm Al Quwain

- Umm Al Quwain Free Trade Zone in Ahmed Bin Rashid Port

- Umm Al Quwain Free Trade Zone on Sheikh Monhammed Bin Zayed Road

Ras Al Khaimah

- RAK Free Trade Zone

- RAK Maritime City Free Zone

- RAK Airport Free Zone

Fujairah

- Fujairah Free Zone

- Fujairah Oil Industry Zone (FOIZ)

Advice of an experienced professional is very important for a successful venture and for the past 17 years, Flying Colour has been assisting clients in all matters related to VAT in the UAE. Please feel free to mail your queries at info@flyingcolour.com or contact us at +971 4 4542366.

To learn more about Tax Provisions for Designated Zones in the UAE, book a free consultation with one of the Flyingcolour team advisors.

Disclaimer: The information provided in this blog is based on our understanding of current tax laws and regulations. It is intended for general informational purposes only and does not constitute professional tax advice, consultation, or representation. The author and publisher are not responsible for any errors or omissions, or for any actions taken based on the information contained in this blog.