UAE Announces New VAT Rules From January 2026-Complete Breakdown

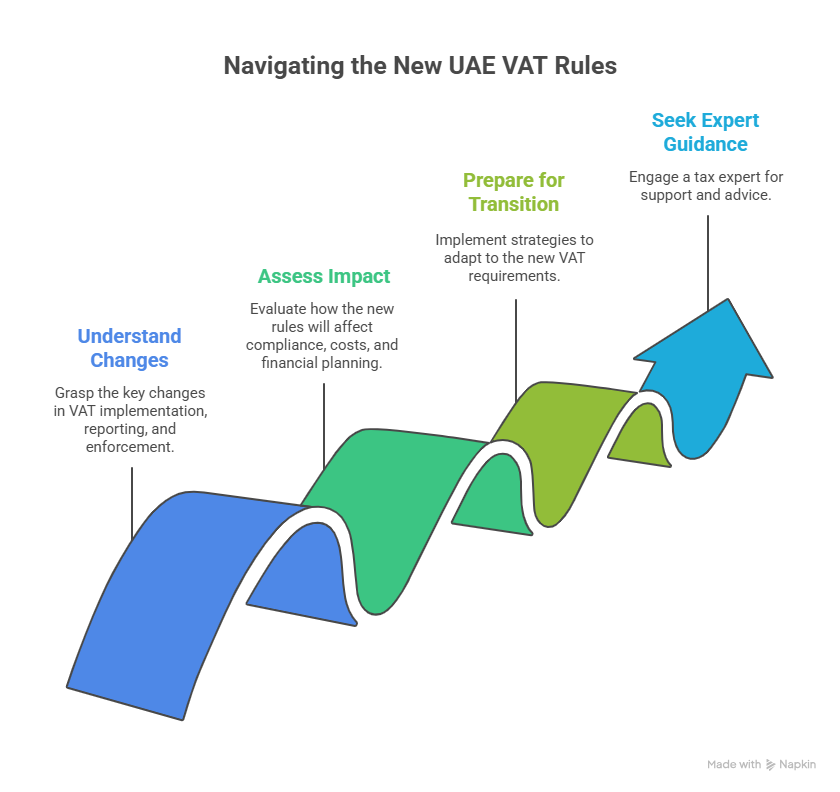

The UAE's VAT announcement for next year is a big deal - & it's been a long time coming since Value Added Tax was first introduced in the Emirates back in 2018. In an ongoing effort to get the country's finances in order, the authorities have made some significant changes that will totally shake things up when it comes to how VAT gets implemented, reported and enforced in various sectors.

People in business, investors and expats alike are all taking a good, hard look at the new UAE VAT rules that are set to kick in next year to figure out just how they're going to affect their compliance requirements, bottom-line costs and financial planning. Whether you're a small outfit, a multinational company or someone who's in charge of tax reporting, you need to stay one step ahead if you want to avoid getting hit with penalties.

This breakdown is going to give you the lowdown on the UAE's new VAT rules - what's changing, what you can expect & how it's all going to affect the wider economy. We'll also be giving you some tips on how to get ready for the transition & why having a trusted tax expert to help guide you through it is a good idea.

UAE VAT Rules Get a Major Overhaul in 2026, and Why It Matters

The UAE continues to keep its tax system up to date in order to get more out of transparency, make governance easier and bring local laws in line with what other governments around the world are doing. The new rules that are being put in place reflect the government's conviction that it has to keep on looking for ways to make its business environment as attractive as possible while at the same time making sure its economy stays financially healthy.

According to some of the major news sources in the region, the changes that are coming in for 2026 are about making things clearer, clamping down on people who try to avoid paying tax and making it easier to sort out any disputes that might come up. So, businesses are going to find themselves having to meet stricter rules, but they will also have the benefit of clearer rules to help cut down on mistakes.

What You Need to Know About UAE VAT Rules 2026

1. Getting The Hang of Taxable Transactions

With the changes coming in for 2026, there will be new and clearer rules on what counts as taxable supplies, zero-rated supplies and exempt transactions. This should make it a lot easier for businesses to get their heads around their tax obligations and reduce the number of mistakes they make.

2. Making it Easier to Stop Tax Disputes

The new rules aim to make it quicker and less painful for people to sort out any disagreements they might have with the tax authorities over VAT payments and penalties. That has to be a good thing for both the tax authorities and the businesses.

3. VAT Registration Rules Get a Makeover

The rules on who has to register for VAT may be changing, so small and medium-sized businesses that used to be outside the VAT net may find themselves having to pay closer attention to their tax affairs. For them, making sure they stay on top of VAT compliance is going to get even more important.

4. Trade Gets a Boost as Cross-Border Rules Get Tougher

The new VAT rules are making it clearer what you have to do when you import, export or have to deal with digital transactions. This means the UAE will be in line with international tax rules, making it easier to trade with other countries.

5. Getting Your Records in Order

The 2026 VAT reforms are all about getting businesses to keep better records and making it easier for the tax authorities to check up on them. This is all about making sure that companies are able to keep track of their tax obligations more easily.

UAE VAT Impact on Businesses: Planning Ahead

Getting your head around how VAT will affect businesses in the UAE is a must if you want to stay one step ahead. The changes are aimed at making the tax system better, but they'll still cause some disruption to the way you run your business:

Changing the Way You Work

With more detailed reporting needed, it's time to think about updating your accounting systems or - if that's not feasible - make the most of what you've got. And with automation becoming increasingly important, you'll need to get your filings spot on from now on.

Reassessing Your Finances

As the rules on what's taxable and exempt become clearer, you might need to have another think about your pricing, how you allocate costs and the contracts with suppliers you've got in place.

Staying on the Right Side of the Law

With the authorities cracking down on non-compliance, the risk of getting hit with penalties is higher than ever. So, it's crucial to keep a squeaky-clean audit trail and make sure your team are up to speed on the new UAE VAT rules.

Navigating UAE VAT in 2026 - What's Coming Down the Line?

Getting a handle on how UAE VAT is going to work in 2026 is definitely a must, especially as the landscape is about to change. The 5% VAT rate may be sticking around for now, but regulatory tweaks are on the horizon - and they'll impact how and when you file taxes, what counts as taxable income, and how you deal with any disputes.

To stay ahead of the game, businesses really need to take a long, hard look at their tax schedules, their reporting procedures and documentation - to make sure everything keeps running smoothly. The UAE VAT 2026 updates also mean the authorities are going to have their fingers on the pulse, so businesses will need to make sure their records are air-tight and accurate.

Getting Your Business Ready for UAE VAT Changes in 2026

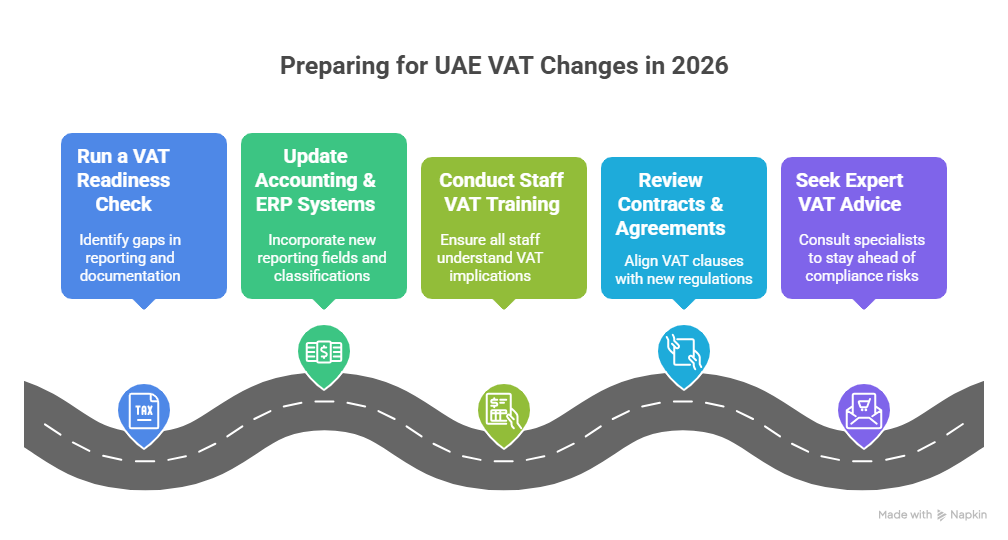

Staying on top of things is key - and that means getting a head start on UAE VAT updates. Here's what you need to be doing to make sure you stay compliant:

1. Run a VAT Readiness Check

Doing a full review helps you spot any gaps in your reporting, documentation and tax treatment.

2. Get Your Accounting & ERP Systems Up to Date

Expect to see new reporting fields, clearer supply classifications, and a few more documentation requirements thrown into the mix.

3. Give Your Staff a VAT Crash Course

Remember, VAT is not just a tax thing - it's a procurement, sales, accounting, finance and logistics issue too, so you need to make sure everyone is on the same page.

4. Take a Close Look at Contracts & Agreements

Make sure your VAT clauses are up to speed with the UAE VAT rules in 2026, so you avoid any future disputes down the line.

5. Get Some Expert Advice

Working with a VAT specialist can really help you make sense of it all - and keep you one step ahead of any compliance risks.

Economic and Sector Impacts of VAT Reform in the UAE

The VAT Reform in the UAE is set to have a diverse impact across various industries :

-

Retail & E-commerce: With the introduction of more transparent digital transaction rules - nothing too complicated to grasp, but a much clearer picture.

-

Real Estate: It's now going to be crystal clear when it comes to treating commercial vs. residential supplies.

-

Hospitality: Adjustments are coming for zero-rated international services.

-

Import/Export: You can bet on more detailed documentation and customs coordination.

-

Freelancers & Consultants: There's a possibility of new registration requirements on the horizon

These adjustments all come together to create a more transparent, more streamlined system, which will definitely help the UAE in its quest to build a world-class regulatory environment.

It's Time to Wrap Up

The UAE VAT announcement in January 2026 signals a major regulatory milestone that's going to shape business operations across the Emirates for years to come . With clearer guidelines, stronger oversight and a look at how the compliance landscape is going to change, companies had better get prepared early if they want to navigate the transition with confidence.

By getting a good grasp of the core elements of the new VAT regulations, assessing how they'll affect your business, and making an investment in professional guidance, businesses can go into 2026 feeling fully prepared and ready to thrive.

How Flyingcolour Tax Consultants Can Help Get You There

Flyingcolour Tax Consultants is here to provide end-to-end support so you can stay on top of the UAE VAT rules 2026. Our team of specialists offers:

-

A comprehensive VAT readiness assessment to make sure you're not missing a thing

-

Personalised guidance on the UAE tax policy changes that affect you

-

Upgrades to your accounting systems so you can get a clear, accurate picture of your finances

-

VAT filing, documentation and audit assistance because, let's face it, you've got better things to do

-

Ongoing advisory to help you navigate the ever-changing VAT landscape with confidence

With deep expertise in UAE taxation, Flyingcolour ensures your business adapts smoothly to the new regulations while minimising risks and maximising your operational efficiency.

Frequently Asked Questions

1. What's the reason for the UAE changing its VAT rules in 2026?

The UAE is updating its VAT laws to build a more transparent system, to drive compliance and to bring itself in line with global tax standards.

2. Is the 5% VAT rate going to change in 2026?

As far as we know, no, the VAT rate remains the same, but the regulations, procedures and compliance rules are all getting updated.

3. How will the VAT changes affect US businesses operating in the UAE?

US companies are going to need to take a closer look at how they classify their supplies, get their documentation in order and prepare for some stricter compliance checks.

4. Do foreign businesses need to register for VAT under the new rules?

If a foreign business meets the revised threshold or conducts any taxable activities in the UAE, it may be required to register.

5. When should companies start preparing for the 2026 VAT updates?

The sooner the better. By getting ahead of the curve now, you'll be able to avoid any operational disruptions and make a smooth transition.

To learn more about The UAE Announces New VAT Rules for 2026 - Your Quick Guide, book a free consultation with one of the Flyingcolour team advisors.

Disclaimer: The information provided in this blog is based on our understanding of current tax laws and regulations. It is intended for general informational purposes only and does not constitute professional tax advice, consultation, or representation. The author and publisher are not responsible for any errors or omissions, or for any actions taken based on the information contained in this blog.