E-Invoicing in Dubai

As more US companies look to break into the Middle East, Dubai has emerged as a key hub for international trade, regional HQs, & for any kind of serious global commerce. One of the major factors behind this growth is e-invoicing in Dubai. A key part of this whole thing is the digital transformation happening in the region, as well as changes to tax laws - all of which are totally reshaping the way US businesses deal with compliance, transparency & operational efficiency in the UAE.

For US companies trading in or operating out of Dubai, keeping on top of how e-invoicing works in Dubai is no longer a nice-to-have - it's a must. Getting a handle on it is vital for VAT compliance, making sure you are audit-ready & making sure the cross-border transactions just keep rolling. Below we take a closer look at how e-invoicing in Dubai helps out US businesses trading across borders, outline the key regulations, & highlight some of the strategic advantages on offer for international companies.

Getting the Lowdown on E-Invoicing in Dubai and the UAE

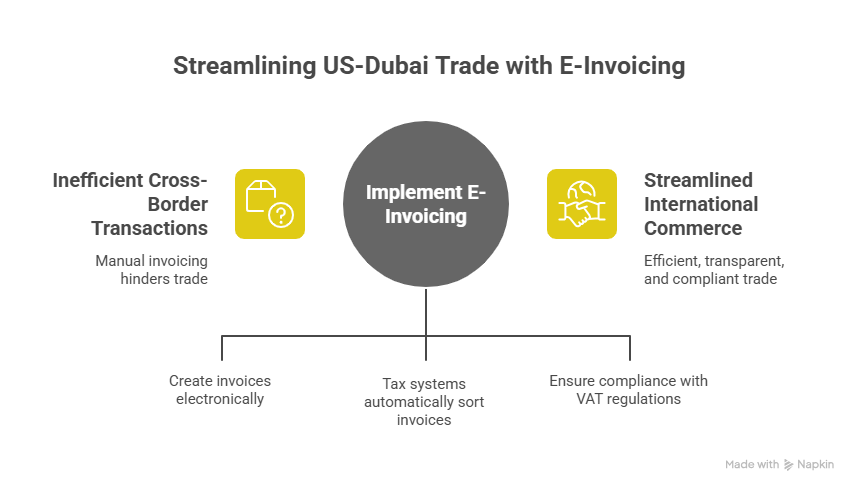

E-invoicing in Dubai is basically all about creating, sending, checking & storing invoices electronically - all in a neat little digital package that meets the UAE authorities' rules. So, unlike just attaching a PDF to an email, e-invoices are actually something a computer can use, so they get automatically sorted out by tax systems.

The UAE government has been steadily working towards a digital invoicing system that's on the same page as the rest of the world. E-invoicing in the UAE is big on forcing people to be open about how much tax they're paying, getting real-time reports and cutting down on all sorts of dodgy dealings - especially with VAT since it came in back in 2018.

For US businesses, all this digitalisation makes it so much easier to get on board with the tax laws, and can even make sending invoices across the border to customers in Dubai, or suppliers/subsidiaries over there a lot faster and a lot more reliable.

Why E-Invoicing in Dubai is a Big Deal for US Companies

Dubai - The Crossroads of International Trade

Dubai is kind of a sweet spot where the US, Europe, Asia and Africa all connect. Loads of US companies already use Dubai as a main base for their logistics, consulting, IT services, manufacturing and energy operations. And as the volume of transactions goes up, so does the scrutiny from regulatory bodies.

Why Dubai E-invoicing Matters for US Companies

Getting e-invoicing right in Dubai for US companies is actually pretty important. It means making sure their cross-border transactions are all square with the UAE VAT laws, while also keeping their US financial systems running smoothly. This is key to cutting down on the friction that can come up in international trade - and making business expansion a whole lot easier.

Compliance is Key for US Companies Operating in Dubai

If you're a US company looking to do business in Dubai, here are a couple of things you should know:

-

If you're registered for VAT in the UAE, you need to be in the know about local e-invoicing regulations\

-

If you're operating through a local branch or subsidiary in Dubai\

-

If you're selling goods or services to UAE businesses and you're going to have to deal with VAT

Getting on top of Dubai's e-invoicing rules is a no-brainer - it means your invoices are good to go, you can keep track of them and the FTA will be happy to accept them.

How E-Invoicing Works in Dubai

To get your head around the benefits of e-invoicing for international trade, you first need to know how e-invoicing actually works in Dubai.

-

Creating an Invoice: First off, the invoice is created in a digital format - usually XML or something similar. And this has got to include all the obligatory VAT details.

-

Making Sure it Checks Out: Next, the invoice has to pass the Dubai VAT e-invoicing rules test - so that means supplier details, VAT registration numbers, tax rates, and how much the transaction is for all have to be spot on.

-

Sending it Over: The invoice then gets sent electronically between the trading partners using approved systems or platforms.

-

Keeping it Safe for Years to Come: Finally, all the e-invoices get stored for the required amount of time, so if there are any audits, you'll be all set.

This whole process cuts down on errors, makes things a lot more accurate and lets you keep a close eye on your compliance in real time.

Understanding Dubai VAT E-Invoicing Rules for US Businesses

Dubai VAT e-invoicing rules are a great illustration of why electronic invoicing is a must-have for businesses that do a lot of international trade. In order to be VAT compliant, invoices need to have a few key pieces of information on them:

-

The supplier's and customer's full legal names and\

-

their VAT registration numbers

And also the date the invoice was issued and a unique number for that invoice\

-

the amount of the bill and how much VAT is included\

-

the tax rate that applies

If you're a US company that isn't super familiar with VAT, then e-invoicing can actually help to reduce your risk of non-compliance and make sure you're following all the UAE tax laws.

Why E-Invoicing in Dubai Helps US Businesses in Cross-Border Trade

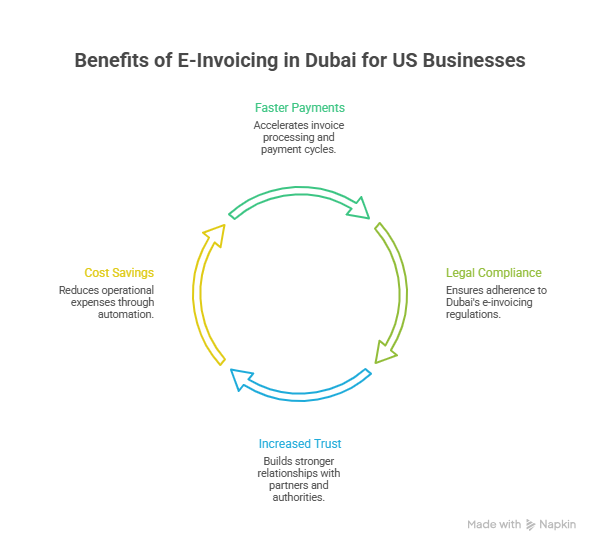

1. You Get Your Money Faster

Using electronic invoicing lets you get invoices out the door and paid so much quicker than you would with paper. And for US exporters and service providers, that means better cash flow and fewer late payments when you're dealing with other countries.

2. You Stay On The Right Side Of The Law

Having a good guide to comply with Dubai's e-invoicing rules helps US companies keep on top of the UAE tax authorities and avoid any problems with audits or penalties.

3. You Get More Trust And Transparency

Digital invoicing creates a clear paper trail, which helps build trust with your UAE business partners, banks and the tax people. And when you're doing business across borders, trust is a pretty big deal.

4. You Save Money On Running Your Business

Automating your invoice process helps cut down on paperwork, human effort and the costs of storing documents. It's a win-win.

Picking the Right e-Invoicing Software for Dubai Compliance - If You're a US Business

Choosing the right e-invoicing software for Dubai compliance is a big decision for U.S businesses, but it's an important one. When you're looking for a solution, here are some things to make sure it's got:

-

Support for UAE VAT regulations

-

The ability to generate invoices in the right format

-

Integrations with your existing ERP and accounting systems

-

Secure ways to store digital documents\

-

And handling of cross-border invoicing rules in Dubai, UAE, which can get pretty complex

If you're a U.S company, a cloud-based platform that can handle compliance in lots of different places around the world is a pretty valuable thing to have.

Getting Ready for Dubai's E-Invoicing Mandate - If You're an International Company

Dubai's e-invoicing mandate for international companies is part of the UAE's long-term plan to go fully digital with its tax administration, and that's only going to get more and more important as time goes on. Even though the rollout might be phased, it's a good idea for international businesses to get ahead of the game and make sure their systems are ready for UAE requirements.

Getting started early lets U.S companies avoid last-minute scrambles to get compliant and just generally make life easier for themselves. By streamlining VAT reporting and scaling up their operations across the region they can free up more time and energy to focus on more important things - like growing their business.

UAE's E-Invoicing Impact on US Businesses - Going Far Beyond Compliance

The impact of UAE e-invoicing on US businesses goes way beyond just ticking the compliance box. It fundamentally changes how finance teams handle international operations and that's a big deal by :

-

Standardising invoicing systems, which is always a good thing

-

Suddenly, you get way more accurate and useful data out of it - and that's a big win for reporting

-

Audit time just got a whole lot easier, thanks to e-invoicing

-

And on the governance side, it lifts the whole global tax burden off your shoulders a bit

By getting on top of this early, US businesses that adapt can start to get a real edge in the Middle East market.

Navigating the Complex Rules of Cross-Border Invoicing in Dubai UAE

Cross-border invoicing rules in Dubai, UAE, are a minefield - but if you can get them right, you'll also get these benefits :

-

Currency conversions stop being a nightmare

-

You can finally get clear on how VAT works for exports and imports

-

The place of supply rules stop being a puzzle and make a lot more sense

-

And all that tedious documentation just automates itself

E-invoicing systems can really help to tame all these complexities, making it easy to get consistent results across the US and UAE.

Strategic Considerations for U.S. CFOs and Tax Leaders

For U.S. finance folk, e-invoicing in Dubai should be seen as a way to unlock potential rather than just a box to tick on the compliance checklist. Some key considerations are:

-

Figuring out how to get US GAAP reporting to line up with VAT documentation without too much fuss\

-

Getting your finance team up to speed on the UAE regulations - that means training them properly\

-

Working with local tax experts to get everything in order\

-

Using automation to ramp up efficiency and make the whole process more scalable

The Bottom Line

E-invoicing in Dubai is a crucial part of making cross-border trade run smoothly, efficiently and without any headaches for U.S. businesses. As the UAE keeps pushing ahead with its digital tax infrastructure, U.S. companies need to be able to adapt to e-invoicing in the UAE or risk getting left behind.

From making VAT compliance a whole lot easier to speeding up international transactions, e-invoicing is a key part of driving sustainable growth and keeping everything running smoothly. For U.S. businesses thinking about expanding into Dubai, getting e-invoicing sorted early on is a smart investment in long-term success.

How Can a Flyingcolour Tax Consultant Really Help You Out?

Flyingcolour Tax Consultant provides top-notch support for US companies trying to get a handle on e-invoicing in Dubai for US companies. Their experts have got it covered:

-

UAE VAT registration and making sure you're in compliance

-

Doing a readiness check on your e-invoicing setup

-

Helping you pick and implement e-invoicing software that's 100% compliant

-

Providing ongoing VAT advice and audit support - so you're always on the right side of the law

-

Sorting out cross-border tax planning and documentation so you can operate with confidence

With a deep understanding of local UAE regulations and international experience, Flyingcolours helps US businesses navigate the UAE regulatory landscape with confidence.

Some Questions We Get Asked a Lot

1. Is e-invoicing compulsory in Dubai for US companies?

E-invoicing rules do apply to VAT-registered businesses in the UAE - and if you're a US company doing business in Dubai, then you'll need to comply with UAE invoicing regulations.

2. How does e-invoicing in Dubai affect cross-border deals?

e-invoicing makes cross-border trade a whole lot smoother - less chance of delays or audit issues.

3. What format do we need for e-invoicing in Dubai?

Invoices have to be in an electronic format that meets UAE VAT and regulatory standards - so not just any old format will do.

4. Can US accounting systems talk to Dubai e-invoicing systems?

Good news - yes, they can. Many e-invoicing solutions integrate pretty easily with US ERP and accounting platforms.

5. Why should US companies get ready for UAE e-invoicing sooner rather than later?

The earlier you get prepare,d the less chance you've got of getting caught out by compliance issues - and it means you can grow your business internationally with confidence.

To learn more about How E-Invoicing in Dubai Supports Cross-Border Trade for U.S. Businesses, book a free consultation with one of the Flyingcolour team advisors.

Disclaimer: The information provided in this blog is based on our understanding of current tax laws and regulations. It is intended for general informational purposes only and does not constitute professional tax advice, consultation, or representation. The author and publisher are not responsible for any errors or omissions, or for any actions taken based on the information contained in this blog.