The Accounting Cycle Breakdown: What You Need to Know to Keep Your Finances in Order

For any US business, getting the books right is not just nice to have - it's necessary. You've got to be on top of your finances to stay in the clear with the laws, know how your business is really doing, and make smart decisions about where to take it next. Whether you're a scrappy startup, a fast-growing firm, or a big-time corporation, having a handle on the accounting cycle is just basic common sense if you want to stay on top of your financial game.

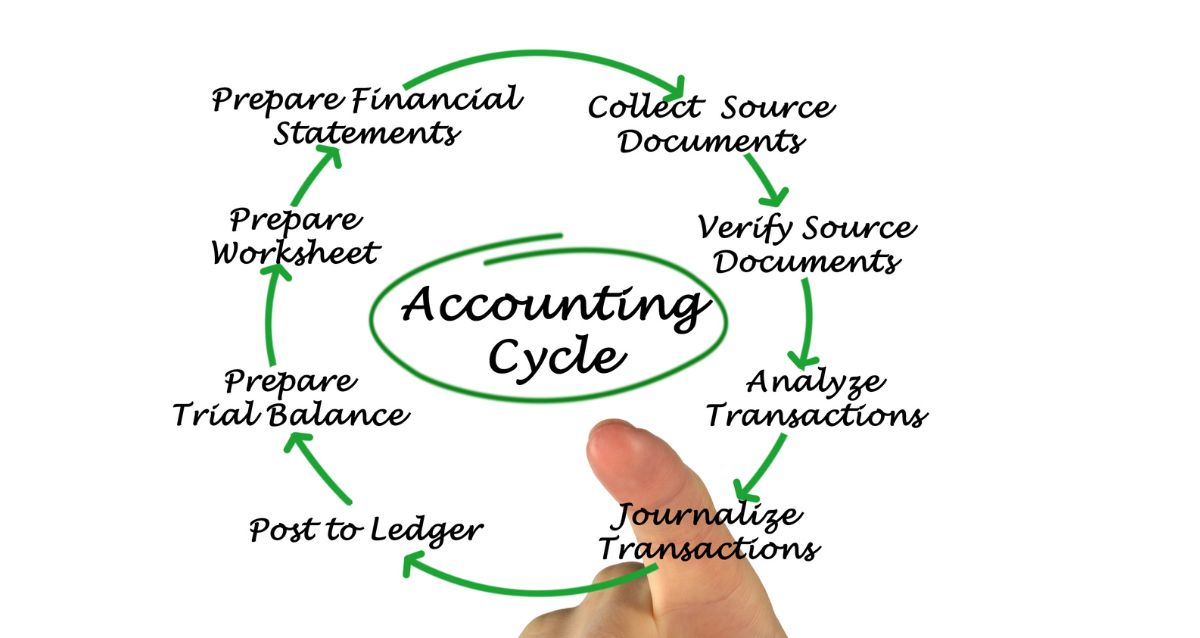

So if you've ever found yourself wondering what steps the accounting cycle actually involves, or if you're just looking for a plain English guide to this whole process, you're in the right place. The accounting cycle is basically just a step-by-step set of rules that tells you how to record, summarise and report your financials in a way that makes sense. It's a routine that you'll be repeating again and again as you go through the ups and downs of business.

This article is here to walk you through the individual steps of the accounting cycle, explain what each one means, and show you why this process is actually pretty important. And because we know our audience is pretty diverse - from accounting newcomers to seasoned business owners - we're including plenty of examples to help illustrate the point, so whether you're a complete beginner or just looking to brush up, you'll be able to follow along and get the most out of these basics.

What is the Accounting Cycle?

The accounting cycle is a well-structured series of tasks that help you sort out, record, and make sense of financial transactions that have taken place within a specific time frame - these time frames are usually months, quarters or a year.

The main idea behind the accounting cycle is to work through each step in a logical order, moving from initial records to the final financial statements, all in a way that is accurate and in line with the rules. In the US, getting this right is a must for tax returns, audits, financial planning, talking to investors, and meeting regulatory requirements.

Why Knowing the Accounting Cycle Really Matters

Companies do a lot better when they get a solid grasp on how the accounting cycle works, including all the individual steps. For example:

-

Accurate financial reports help make smart business decisions

-

Cutting down on accounting mistakes is a big win

-

Staying on top of tax and financial regulations is super important

-

You get better insight into how well your business is doing and where it can improve

-

It makes it much easier to get ready for an audit

-

You also get a clearer view of what your bottom line is

If you don't get the accounting cycle right, though, you can run into all sorts of problems - stuff like bad financial management, compliance risks, and making poor business decisions.

The Accounting Cycle: Breaking it Down Step by Step

Now, let's dive into the accounting cycle process with examples, making sure we get the accounting cycle explained and understood.

Step 1: Spotting & Analysing Transactions

The very first stage in the accounting cycle process is identifying business transactions. We need to find every single thing that affects our financial situation – and make sure we capture it.

Some examples of the types of transactions we'd consider are:

-

Revenue from sales

-

Expenses & payments

-

New asset purchases

-

Loan repayments

-

Payroll expenses

For instance, if your company buys office equipment for $3,000, you've got to identify that as an asset acquisition and a corresponding reduction in cash.

Getting this right means everything will flow through the accounting cycle correctly.

Step 2: Logging Transactions in the Journal (Journal Entries)

Next up in our accounting cycle journey to financial statements, we need to record those transactions in our general journal. We use the double-entry bookkeeping method for this.

Each entry will typically have:

-

A debit

-

A credit

-

A brief description of what we're doing

To illustrate, here's what an example journal entry might look like:

-

Account:

-

Debit:

-

Credit:

Office Equipment

$3,000

Cash

$3,000

Journalising transactions is a fundamental skill in the accounting cycle for beginners, because it helps us keep things accurate and on the right track.

Step 3: Putting Entries in the Ledger

Once we've finished journal entries, we move them over to the general ledger – a tidy record of all our accounts.

This is a crucial step in the accounting cycle because the ledger sums up the balances for:

-

Our assets

-

Liabilities

-

Equity

-

Revenue

-

Expenses

For example, that office equipment purchase for $3,000 will get added to our equipment ledger and cash ledger.

Getting our ledger sorted like this will make the later stages of the accounting cycle in financial accounting so much clearer.

Step 4: Double-Checking Your Unadjusted Trial Balance

Once you've gotten everything posted in your ledger, it's time to take stock and make sure the numbers add up in the unadjusted trial balance. This is where you check to see if total debits really do equal total credits.

This step's kind of like a sanity check to make sure your math's on track before you go making any adjustments. If you find out that the numbers don't match up - well, you need to track down where that error is and fix it before you can move on.

This is a big part of the accounting cycle - the part where you really get to put the brakes on and double-check your work before you go any further.

Step 5: Time to Get Your Adjustments In

So here's the deal: every accounting period, you're going to have some situations where the books just aren't quite reflecting what's really going on. So one of the more crucial steps in the accounting cycle is making sure to get those adjusting entries in.

These kinds of entries cover things like:

-

The bills you still haven't paid\

-

The money that's still coming in that you haven't banked\

-

Stuff you paid for upfront that will have lasting benefits (like a year's worth of insurance)\

-

And the wear and tear on your assets over time

Let's say, for example, you still haven't paid your $5,000 rent bill... You'll need to log that as an accrued expense so that you can accurately account for the income and expenses that actually happened within the accounting period. And doing that will mean you're playing by the rules of GAAP and staying in line with American accounting standards.

Step 6: Prepare the Adjusted Trial Balance

After you've made all the necessary adjustments, an adjusted trial balance gets generated. And that confirms that debits still equal credits - which is just what you're after after making all those corrections.

This is a second quality check in the accounting cycle (as explained elsewhere) to double-check that everything is accurate before you start generating reports.

Step 7: Time to get the Financial Statements out the Door

Okay, now that the accounting data is all sorted, it's time to turn it into actual financial reports. And this is actually one of the most important steps in the accounting cycle, because financial statements are what guide business management decisions and make sure companies comply with all the rules.

So what gets prepared includes:

-

The Income Statement

-

The Balance Sheet

-

The Cash Flow Statement

-

The Statement of Changes in Equity

All these reports give a clear picture of how the business has been performing and where it stands financially - and that's useful information for all sorts of stakeholders. This step is what connects all those journal entries you made during the accounting cycle to the actual financial statements.

Step 8: Writing off those Temporary Accounts

At the end of each accounting period, you take care of the revenue, expense and withdrawal accounts so that you're all set for the next cycle.

Temporary accounts that get closed include:

-

All your revenue accounts

-

All your expense accounts

-

Dividend or drawing accounts

What gets done with all those balances is - they get transferred into retained earnings or capital.

And that's the last step in the accounting cycle for that particular period.

Step 9: Wrapping Up the Post-Closing Trial Balance

Now that closing entries are out of the way, a post-closing trial balance gives you a clean slate - all those temporary accounts are zeroed out, and only the permanent ones are left standing.

This is a pretty good way to confirm that the final balances are just right and that the company is all set up for the next accounting cycle.

It's time to start again from the top - and that means completing the accounting cycle step by step.

Accounting Cycle Steps in a Simple Business Scenario

Let's imagine a small US business - just a tiny little thing that buys inventory for $10,000.

-

They go out and buy some stuff (Inventory for $10,000).

-

They record the journal entry: Inventory Debit, Cash/Credit Payables Credit.

-

They post those entries to the ledger accounts.

-

Then they whip up an unadjusted trial balance.

-

After that, they have to make some adjustments for depreciation or unpaid expenses.

-

Once they've made those adjustments, they create an adjusted trial balance.

-

Next up, they crank out some financial statements.

-

Then they close out revenue and expense accounts.

-

And finally, they get to prepare the post-closing trial balance.

That's the accounting cycle explained in a nutshell - with just a simple business example.

Key Tips for Beginners Learning the Accounting Cycle

If you're just starting out learning the accounting cycle, keep these simple tips in mind:

-

Keep your documentation up to date and accurate

-

Use some decent accounting software to make life easier

-

Stick to consistent recording methods - it makes life a lot simpler

-

Make sure to keep your business and personal finances separate

-

Check up on compliance requirements regularly (just to be on the safe side)

These simple tips will help you manage the accounting cycle in financial accounting with a lot less stress.

How Flyingcolour Tax and Accounting Setup Can Help You with Your Accounting Cycle

Managing financial reporting in line with all the U.S. and international standards can be a real pain. Whether you're running a brand new startup, a small or medium-sized enterprise, or a big, fat, established operation, let the pros take care of your accounting cycle process for you.

Flyingcolour Tax and Accounting is here to help - and we're experts in:

-

Full accounting cycle management (from start to finish)

-

Bookkeeping and ledger maintenance (so you don't have to worry about those boring details)

-

Journal entry and trial balance preparation (just the tedious bits)

-

Financial statement prep (to make sure you're always in the black)

-

Tax compliance and advice (so you stay on the right side of the law)

-

Cloud accounting solutions (to keep you up to speed with the latest tech)

-

And internal control support (so you can stay confident in your financial numbers)

By partnering with our experienced accounting pros, you can avoid errors, save time, get your compliance sorted, and feel confident in your financial results.

Understanding the accounting cycle is pretty crucial if you want to stay on top of your finances and keep your business running smoothly in the USA. From tracking those transactions to whipping up financial statements and closing out the books, every step in the process is important.

A well-planned accounting cycle process is what keeps your business healthy, transparent, and ready for growth.

Frequently Asked Questions

1. What are the steps in the accounting cycle?

It's pretty straightforward - identify transactions, record journal entries, post to ledgers, prep trial balances, make some adjustments, generate financial statements, and close the books.

2. How often do I need to go through the accounting cycle?

Most businesses go through it monthly, quarterly, or annually - it just depends on how often you need to report.

3. Do small businesses really need to go through the accounting cycle?

Yes - even small businesses can benefit from following a structured accounting cycle to make sure their finances are accurate and compliant.

4. Is accounting software a big help in managing the accounting cycle?

Absolutely - it simplifies the accounting cycle, cuts down on errors, and automates reporting.

5. Can I outsource my accounting cycle to a professional?

Yes - and it can be a lifesaver - especially for U.S. businesses.

To learn more about What Are the Steps Involved in an Accounting Cycle? A Complete Guide for the USA, book a free consultation with one of the Flyingcolour team advisors.

Disclaimer: The information provided in this blog is based on our understanding of current tax laws and regulations. It is intended for general informational purposes only and does not constitute professional tax advice, consultation, or representation. The author and publisher are not responsible for any errors or omissions, or for any actions taken based on the information contained in this blog.